Is vision impairment a disability under insurance policies? Learn how vision loss is evaluated for Long Term Disability claims and what evidence is needed to qualify.

Questions about vision impairment are common for individuals whose eyesight affects their ability to work. Vision impairment can significantly limit daily activities, job performance, and long-term earning capacity, but whether it qualifies as a disability depends on how the condition impacts functional ability and how disability is defined under the applicable policy or program.

Understanding how vision impairment is evaluated is essential when pursuing Short Term or Long Term Disability benefits.

When Vision Impairment May Qualify as a Disability

Vision impairment can qualify as a disability when it substantially limits one or more major life activities, including the ability to perform work-related tasks. This may include conditions such as:

- Partial or total vision loss

- Legal blindness

- Progressive eye diseases such as macular degeneration, glaucoma, or retinitis pigmentosa

- Severe visual field loss

- Diabetic retinopathy or other vision-related complications of systemic disease

The key issue is not the diagnosis alone, but how the condition affects functional capacity. Insurers evaluate whether the impairment prevents the claimant from performing the material and substantial duties of their occupation, or any occupation, depending on the policy definition.

How Disability Insurance Policies Evaluate Vision Impairment

Most Long Term Disability policies define disability in one of two ways:

- Own occupation: The inability to perform the duties of the claimant’s specific occupation

- Any occupation: The inability to perform the duties of any occupation for which the claimant is reasonably qualified

Vision impairment may meet either definition if the limitations are well documented and clearly related to job requirements. For example, individuals whose work requires reading, driving, operating machinery, or prolonged computer use may face greater challenges demonstrating work capacity with reduced vision.

Insurers often focus on measurable criteria such as visual acuity, visual field testing, and consistency of treatment records.

Medical Evidence Required for Vision-Based Disability Claims

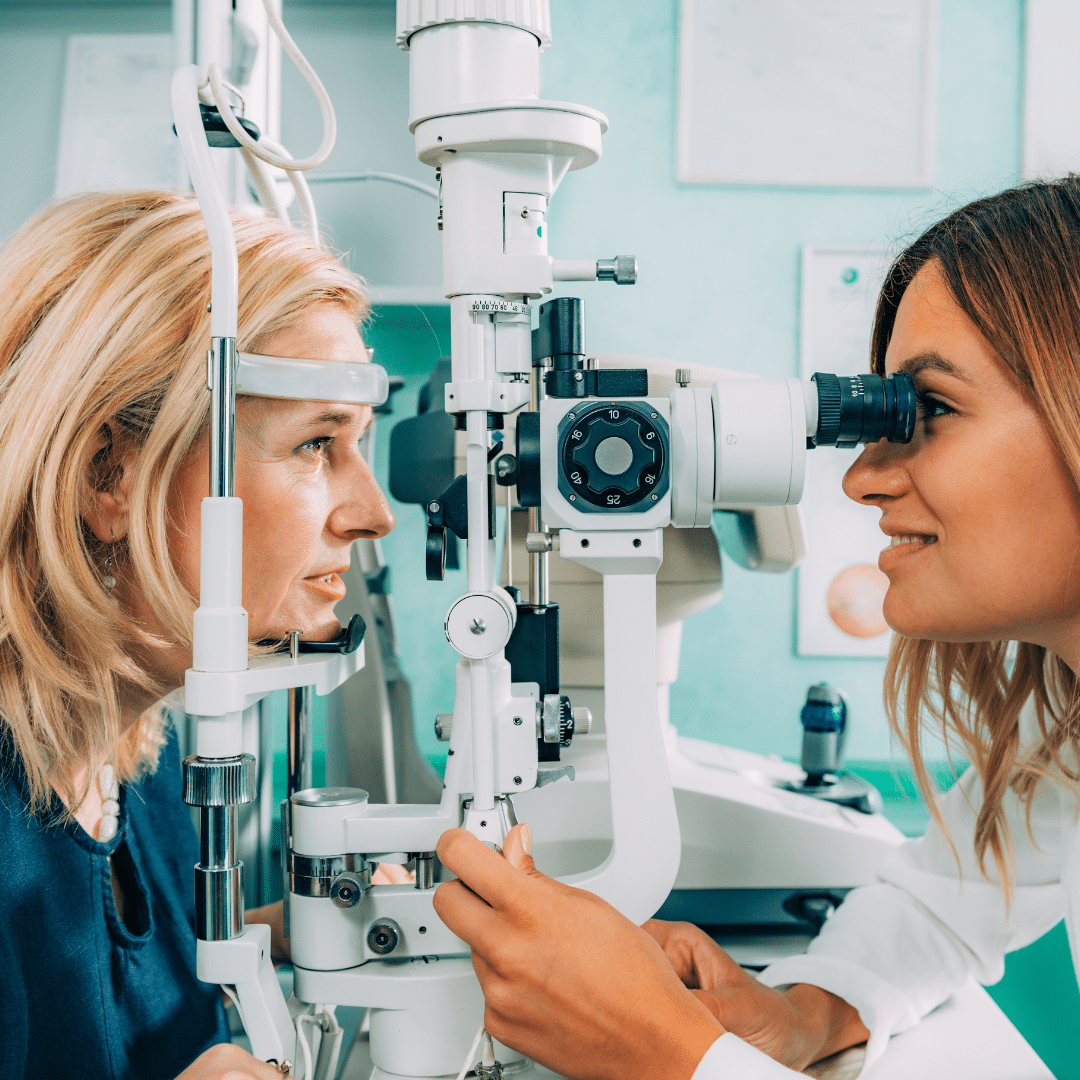

Strong medical documentation is critical in any vision impairment disability claim. Insurers commonly require:

- Comprehensive ophthalmologic or optometric examinations

- Visual acuity and visual field test results

- Imaging studies, when applicable

- Treatment history and prognosis

- Physician statements describing functional limitations

It is imperative that medical records clearly explain how the vision impairment limits work activities. Claims are often denied when records focus only on diagnosis and not on functional impact.

Common Challenges in Vision Impairment Disability Claims

Claimants with vision impairment often face obstacles such as:

- Insurers arguing that assistive devices or accommodations allow continued work

- Claims that the condition is stable and non-progressive

- Disputes over whether visual limitations are severe enough to prevent employment

- Inadequate explanation of job-specific visual demands

These challenges make careful claim preparation and strategic documentation essential.

Protecting Your Long Term Disability Claim

Vision impairment can be life-altering, especially when it interferes with employment and financial stability. Understanding how insurers evaluate these claims and what evidence is required can significantly improve the likelihood of success.

If you are asking, “Is vision impairment a disability?” and are struggling with a denied or delayed claim, professional legal guidance can help ensure that your limitations are accurately presented and properly evaluated.

Contact Us for Help With a Vision Impairment Disability Claim

If vision impairment is affecting your ability to work and you are facing challenges with a Short Term or Long Term Disability claim, the attorneys at Herbert M. Hill, P.A. can help. Our practice is dedicated to representing individuals in disability insurance claims and appeals, and we understand how insurers evaluate vision-based limitations.

Contact us today to schedule a free consultation and learn how we can help you protect your rights and pursue the disability benefits you deserve.