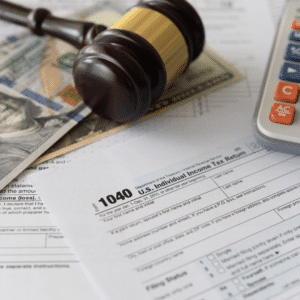

A Long Term Disability (LTD) insurance policy is designed to provide a safety net during unemployment due to a medical condition. The question always arises: Are my benefits taxable?

Understanding LTD Policies and Taxation

First, there are basically two (2) kinds of LTD policies: first, there is the private policy taken out and paid for on an individual basis. The benefits paid under such policies are not taxable unless the premiums were paid, for whatever reason, by a third party.

Taxation of Group LTD Benefits

The second type of policy is a group policy issued by employers as part of the company’s benefit package. Generally, the federal statute known as the Employee Retirement Income Security Act (“ERISA“), found at 29 U.S.C. ¶¶ 1001, et se, governs these policies.

I say “generally” because there are certain employer-issued group LTD policies that ERISA does not govern. These are governmental or church employers.

Taxation of group LTD benefits depends on various factors, including how the premiums are paid and whether the employer or the employee bears the cost. Whether LTD benefits are taxable depends on who pays the premiums. Possible scenarios include the following.

Determining Tax Liability for LTD Benefits

If the employer pays the entire premium for the LTD policy, any benefits you receive will generally be taxable as ordinary income. Essentially, the entire amount you receive as LTD benefits will be subject to taxation at the federal and state levels.

On the other hand, when the employee pays the entire group LTD premium, the benefits are generally not taxable. Care must be taken to ensure that the premiums are paid with after-tax dollars, i.e., that they are based on dollars on which taxation has already occurred. The federal tax law provides that if taxes have already been paid on the premium dollars, there is no tax on the benefit dollars.

When determining whether you, as the employee, paid the LTD premiums, the starting point is reviewing the explanation of your payroll checks or advice, which show the deductions from gross pay.

However, the inquiry continues just because there is a deduction for LTD premiums. Sometimes, the employer and the employee may pay part of the group LTD premiums. In such situations, the taxability of the benefits depends on the proportion of premiums paid by each party.

Additional Considerations and Offsets

There are additional considerations. While the above provides a general overview of the taxation of ERISA Long Term Disability benefits, it is essential to consider the impact of factors such as the circumstance in which your Social Security benefits are taken as an offset against your LTD benefits.

This offset, if taken, operates to reduce the amount of taxable income you must recognize from the standpoint of LTD benefits. Of course, Social Security benefits must also be considered for income tax purposes. This would be true if there is an offset from any other source, such as worker’s compensation claims or pension benefits received.

Consultation and Further Assistance

Of course, you must consult with a tax advisor about the specific ins and outs governing your ultimate tax liability. This blog should be used as general guidance on this subject because the specific details vary from person to person. Given the complexity of tax laws and each individual’s unique circumstances, you must consult a tax advisor for the guidance you need.

Contact Our Long Term Disability Law Firm Today

If you have any questions about your Short Term Disability or Long Term Disability claim, contact the team at Herbert M. Hill, P.A. After discussing your case, we can set a conference to discuss the matter further, if warranted. The initial telephone call and the follow-up conference are free of charge.

Herbert M. Hill, P.A. is a law firm located in Orlando, Florida, with a practice extending throughout the state. Our focus is cases involving claims for disability insurance benefits and related employment issues, including claims arising under a private disability policy.